Asia's Emerging Manufacturing Powerhouse

Sourcing from Asia’s Rising Manufacturing Hub!

Asia's Emerging Manufacturing and Sourcing Powerhouse

Insights into Vietnam

Positioned strategically in Southeast Asia, Vietnam is gaining prominence as a leading player in the global manufacturing industry. With impressive growth across various sectors, from electronics and furniture to textiles and footwear, Vietnam’s manufactured products have become a major contributor to the global supply chain. Despite its developing status, the country is known for delivering high-quality manufactured products at competitive prices, enhancing its appeal as a top global sourcing destination.

The country

With a history stretching over a thousand years, Vietnam has been a cultural and trade hub in Southeast Asia, known for its resilience and artistry. Situated along ancient trade routes, it has emerged over the past four decades as a rapidly growing economy and a center of innovation. Today, Vietnam combines a deep cultural heritage with forward-looking development, creating a unique blend of traditional charm and modern dynamism. From the storied streets of Hanoi in the north to the bustling, cosmopolitan energy of Ho Chi Minh City in the south, Vietnam captivates with its landscapes, historical landmarks, and renowned cuisine.

Vietnamese people are celebrated for their strong work ethic and cultural pride, which is reflected in their high-quality craftsmanship across Vietnam’s manufacturing industries. This dedication is evident in goods ranging from hand-crafted textiles to advanced electronics. Vietnam’s young population, with over 45% pursuing studies in STEM fields—the highest in Southeast Asia—is fueling its manufacturing prowess and innovation capacity. These cultural and technical strengths, coupled with its strategic location, have positioned Vietnam as a competitive global manufacturing exporter.

The economy

Vietnam has grown into a manufacturing powerhouse in Southeast Asia, providing a compelling alternative to China. The past decade has seen robust GDP growth and significant export expansion, particularly in high-demand sectors such as electronics, textiles, and consumer goods. With a young, industrious workforce and pro-business policies, Vietnam has strengthened its position in the global economy and continues to attract foreign investment.

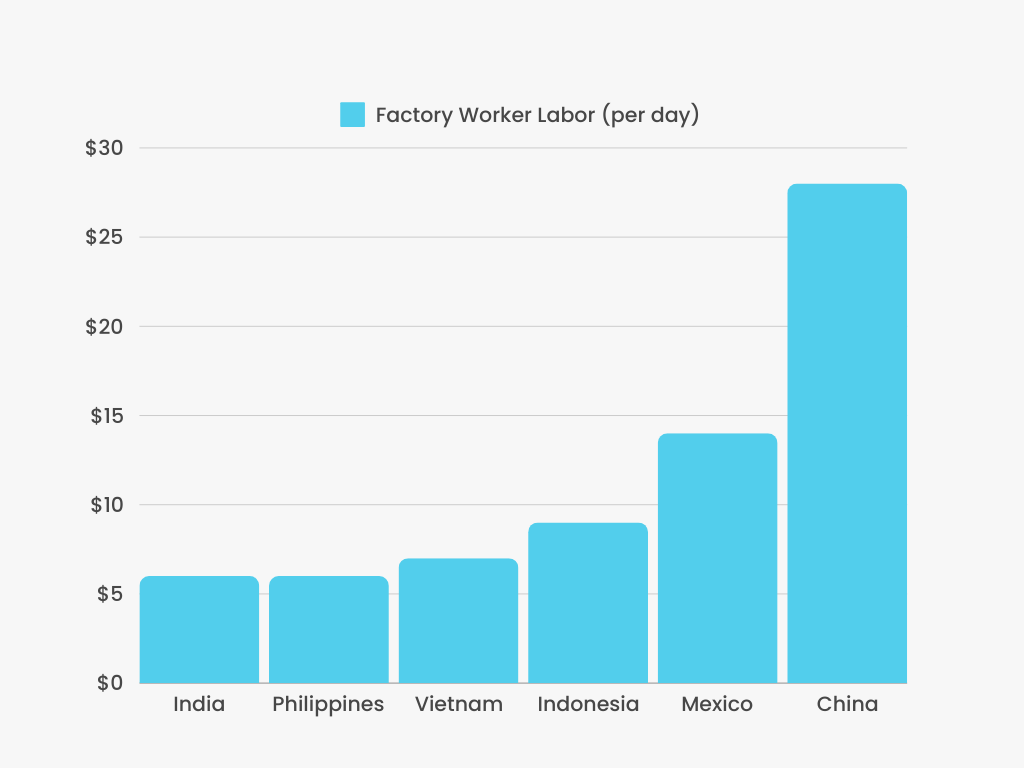

Strategically located within Southeast Asia, Vietnam offers manufacturing at labor costs up to 30-40% lower than other major hubs like China. By 2024, the manufacturing sector represented over 20% of Vietnam’s GDP, supported by rising foreign direct investment and industrial development. Businesses benefit from Vietnam’s streamlined airports and modern ports, enhancing cost efficiency and reliability in international shipping.

Key Industries

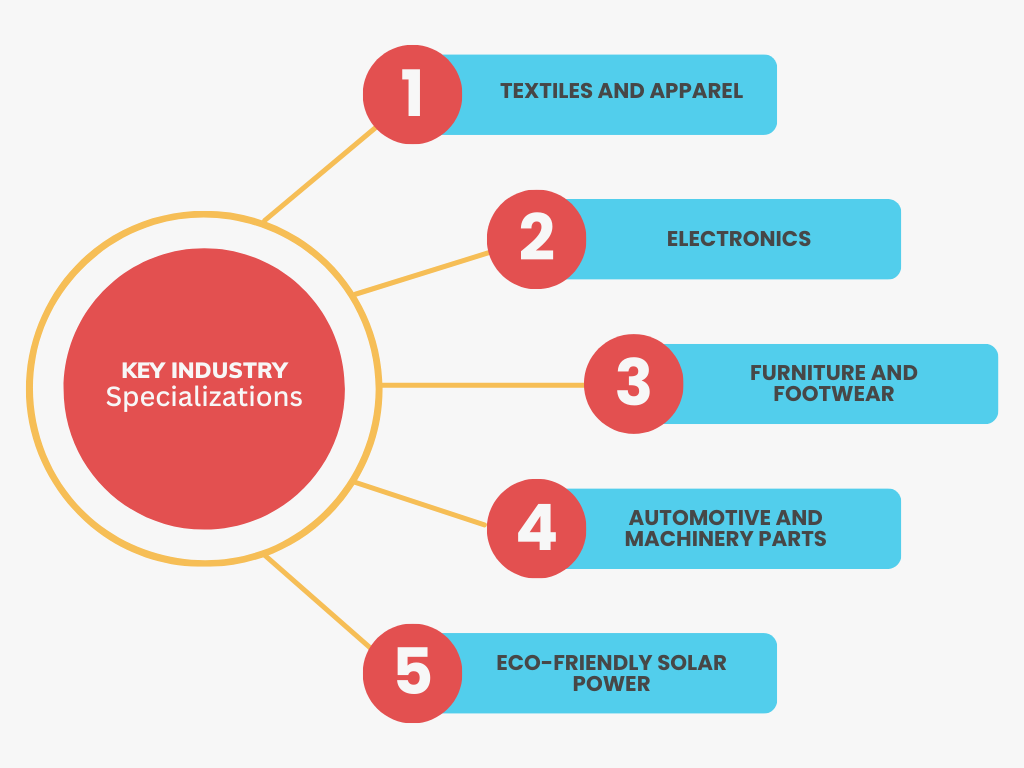

Vietnam’s manufactured product exports grew 10% in 2024, with the United States being Vietnam’s largest export market with an estimated turnover of USD 98.4 billion. Vietnam’s manufacturing industry is marked by growth and diversity, with major contributions from textiles, electronics, furniture manufacturing, and many other industries. Textiles remain a standout sector, generating over $39 billion in annual exports and positioning Vietnam among the top five global exporters. Thanks to investments from major brands such as Samsung and Japanese firms, electronics have also flourished, transforming Vietnam into a leading high-tech manufacturing base with exports exceeding $100 billion in 2023.

The country’s manufacturing strength extends to furniture and footwear, where Vietnam ranks among the world’s top exporters. It also has a steadily expanding automotive parts industry that supports regional supply chains. Notably, Vietnam has embraced sustainable manufacturing practices, operating thousands of solar-powered factories as it aims for 30% renewable energy capacity by 2030. Together, these sectors reflect Vietnam’s rise as a sustainable and competitive manufacturing powerhouse in Southeast Asia.

Textiles and Apparel: Vietnam is one of the top five textile exporters globally, generating over $39 billion annually in textile exports. Known for skilled hand assembly and high-quality garment production, the sector employs over 2.5 million workers, focusing on intricate detailing and diverse apparel types.

Electronics: With facilities for major brands like Samsung, which invested around $17 billion in Vietnam, the electronics industry has grown into a critical high-tech manufacturing hub. In 2023, electronics exports surpassed $100 billion, accounting for nearly 25% of Vietnam’s total exports.

Furniture and Footwear: Vietnam ranks among the top five furniture exporters worldwide, with exports valued at over $13 billion. Known for its craftsmanship and affordable production, the country also leads in footwear manufacturing, shipping approximately 1 billion pairs annually to global markets.

Automotive and Machinery Parts: Vietnam’s automotive components sector has grown by over 20% annually. With over $10 billion in Vietnam manufacturing products exported in 2024, it now produces a wide range of parts, contributing to a regional supply chain that serves major auto brands across Asia and beyond.

Eco-Friendly Manufacturing: Vietnam’s government is actively promoting sustainable energy practices with wind, solar, and hydropower generation accounting for 42% of the country’s energy supply in 2024.

Logistics

Vietnam’s logistics infrastructure has advanced rapidly, positioning it as a competitive hub for global trade and manufacturing exports. With over 80 seaports and over 20 airports, the country efficiently connects products from Vietnam to the global market. Investments from logistics giants like FedEx and DHL support reliable, quick shipments to the U.S., Europe, and beyond. Backed by over $5 billion in improvements to road, rail, and port infrastructure by 2025, Vietnam’s logistics network is prepared to support continued export growth and global supply chain demands.

This strong logistics foundation bolsters Vietnam’s leading export industries, which have experienced remarkable expansion over the last decade. Vietnam’s expanding logistics infrastructure supports its diverse manufacturing base, establishing it as a vital force in the global economy.

Pricing Edge

Vietnam’s competitive labor market provides a significant price advantage, with labor costs estimated to be 30-40% lower than those in China. This cost-effectiveness is particularly beneficial for labor-intensive industries such as textiles and electronics, where efficiency and quality are paramount.

In addition to its lower labor costs, Vietnam’s strategic positioning as an alternative to China is reinforced by its commitment to developing a higher value manufacturing environment driven by more than 100,000 STEM graduates a year over the last decade. The Vietnamese government offers substantial support through favorable tax policies, including corporate tax rates as low as 10% in certain sectors. With free trade agreements in place with more than 50 countries, including the EU and the UK, Vietnam continues to enhance its appeal for international businesses seeking cost-effective export opportunities across various industries. This combination of competitive pricing and supportive policies positions Vietnam as a key player in the global manufacturing landscape.

Tariffs

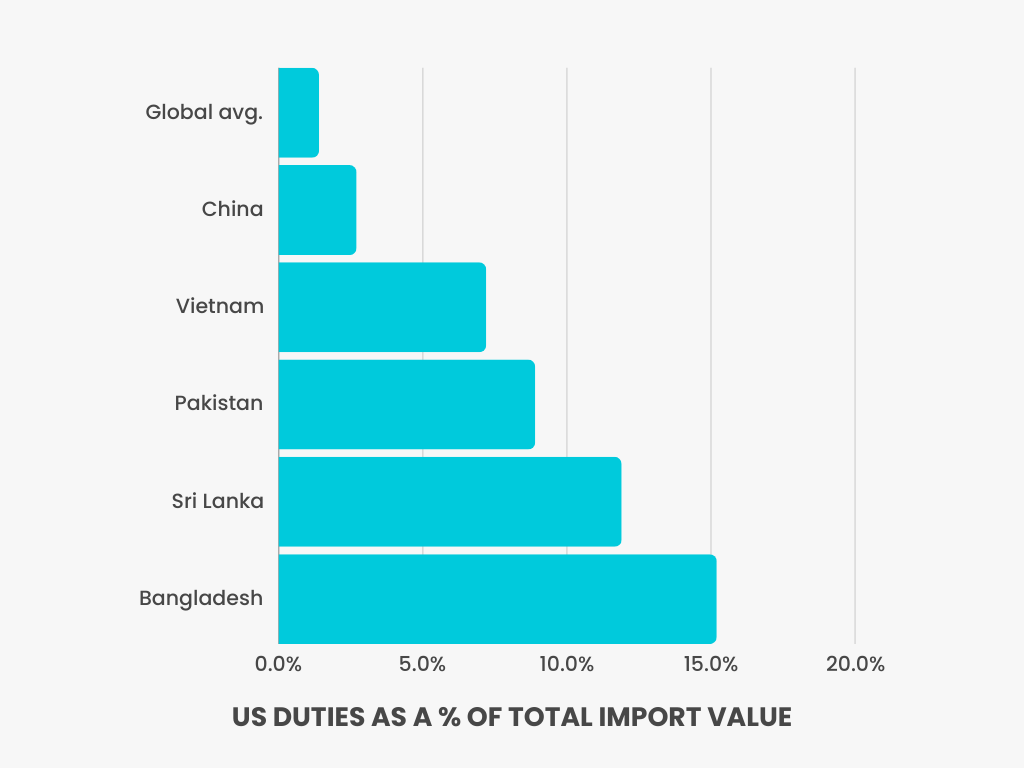

Custom duties vary significantly by country of origin, making it essential to understand the tariff implications for products imported from Vietnam. While many businesses focus on the tariffs imposed on Chinese goods, it’s important to note that Vietnam also faces considerable import duties, particularly in the clothing sector. Currently, Vietnam contributes significantly to the U.S. clothing market, which imports over 97% of its apparel.

Looking ahead, the potential for a 20-60% increase in tariffs on Chinese goods from the U.S. (and possibly other markets) in 2025 this further enhances Vietnam’s manufactured products as a sourcing alternative. With tariffs on Chinese products rising, businesses are likely to explore Vietnam as a cost-effective option. This shift not only makes Vietnam an appealing destination for sourcing textiles and electronics but also underscores its role as a viable substitute for companies seeking to mitigate rising costs associated with Chinese imports. As tariffs evolve, understanding the landscape of duties and sourcing options will be vital for maintaining competitive pricing and profitability in an increasingly complex trade environment.

Vietnam’s rise as a global manufacturing hub is fueled by its strategic location, competitive pricing, and a strong workforce dedicated to quality craftsmanship. As businesses seek cost-effective alternatives in an evolving global market, Vietnam stands out as a premier sourcing destination across industries. Ready to learn more about how Vietnam can transform your supply chain? Explore our sourcing solutions today and connect with our experts.

Get a Vietnam global sourcing supplier report!

Click Here